XRP Price Prediction: Technical and Fundamental Analysis Points to $3 Breakout Potential

#XRP

- Technical indicators show bullish momentum with MACD positive divergence and price trading near upper Bollinger Band

- Regulatory clarity from settled SEC lawsuit removes major uncertainty and institutional barrier

- Growing institutional adoption through ETF filings, stablecoin integration, and 401(k) policy changes creates fundamental support

XRP Price Prediction

Technical Analysis: XRP Trading at $3.0266 with Bullish Momentum Indicators

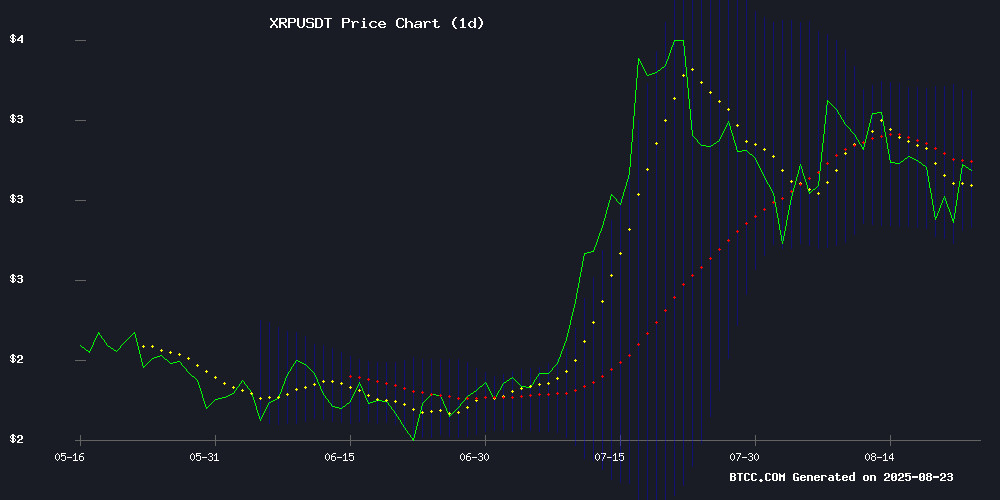

XRP is currently trading at $3.0266, slightly below its 20-day moving average of $3.0946. The MACD indicator shows bullish momentum with a value of 0.0776 above the signal line at 0.0270, while the histogram reading of 0.0506 confirms positive momentum. Bollinger Bands position the price between the upper band at $3.3577 and lower band at $2.8314, suggesting potential volatility ahead. According to BTCC financial analyst Robert, 'The technical setup indicates consolidation with upward bias, though breaking above the 20-day MA remains crucial for sustained momentum.'

Regulatory Clarity and Institutional Adoption Fuel XRP Optimism

The closure of the SEC vs Ripple case with a $125 million penalty removes significant regulatory overhang, while updated spot XRP ETF filings and Ripple's RLUSD stablecoin launch in Japan create additional bullish catalysts. Institutional interest is further amplified by 401(k) policy shifts enabling potential trillion-dollar ETF inflows and Ripple's strategic credit line to Gemini. BTCC financial analyst Robert notes, 'The combination of regulatory resolution and expanding institutional infrastructure creates a fundamentally stronger environment for XRP's adoption trajectory.'

Factors Influencing XRP's Price

SEC vs Ripple Case Officially Closed, Spot XRP ETF Filings Updated

The United States Court of Appeals for the Second Circuit has approved the joint stipulation of dismissal for the SEC's appeal against Ripple Labs, marking the official end of the lawsuit filed in late 2020. The decision, issued on August 22, 2025, has been met with relief by the XRP community and the broader crypto industry.

Institutional investors reacted swiftly to the regulatory clarity, with seven fund managers—led by Graysvale Investment—rushing to update their spot XRP ETF filings ahead of an October deadline. "Bunch of XRP ETF filings being updated by issuers today," noted ETF analyst James Seyffart. "Almost certainly due to feedback from the SEC."

The resolution removes a key overhang for XRP, which has seen growing market momentum amid fading legal uncertainty. Ripple's native token now faces a critical test of investor confidence as the industry watches for further institutional adoption.

Ripple's RLUSD Stablecoin Launch in Japan Sparks Altcoin Interest

Ripple is set to introduce its RLUSD stablecoin in Japan through a partnership with SBI VC Trade, targeting a Q1 2026 launch. The move signals growing regulatory acceptance of reserve-backed stablecoins in the region. RLUSD, pegged to the dollar and backed by cash and Treasuries, offers speed on the XRP Ledger and DeFi compatibility on Ethereum.

While XRP will dominate headlines, the announcement may draw attention to smaller altcoins with strong utility or community backing. Traders often seek secondary beneficiaries when major players like Ripple make strategic moves, creating opportunities beyond the obvious candidates.

Ripple-SEC Lawsuit Concludes with $125M Penalty as XRP Rallies

The protracted legal battle between Ripple Labs and the U.S. Securities and Exchange Commission reached its denouement as the Second Circuit Court approved a joint dismissal of appeals. The resolution leaves Ripple liable for a $125 million penalty—an amount upheld by Judge Analisa Torres despite earlier negotiations to reduce it to $50 million.

Market reaction was immediate, with XRP surging 5.57% to $3.06 following the news. The token's 89% intraday rebound from $2.78 reflects renewed investor confidence after years of regulatory uncertainty.

Legal observers note the dismissal eliminates a key overhang for institutional crypto adoption, though the upheld penalty reinforces the SEC's stance on securities law violations. Ripple had previously escrowed the funds pending appeal.

Earn 1,053 XRP Daily with SIX MINING Cloud Mining — Ride the 2025 XRP Boom!

Big money is pouring into XRP as regulatory clarity emerges, with Ripple's $125 million SEC settlement marking a turning point. The token has surged 481% year-to-date, peaking at $3.10, while institutional interest grows—Nasdaq-listed Thumzup Media recently allocated $50 million to XRP assets.

Regulatory frameworks are crystallizing, with the SEC and CFTC delineating oversight roles. Ripple's pending national bank charter application could further legitimize its position in financial systems. Potential ETF approvals and the charter decision in October may catalyze another price surge.

SIX MINING capitalizes on this momentum by offering cloud-based XRP mining, positioning itself as a low-barrier entry point for retail investors. The platform promises 1,053 XRP daily yields without hardware requirements, though profitability depends on sustained XRP appreciation.

Ripple CTO Highlights Simplicity and Custody as Key Drivers for Crypto Adoption

Ripple's Chief Technology Officer, David Schwartz, asserts that mainstream cryptocurrency adoption hinges on simplifying blockchain technology for everyday users. The company is reportedly months away from significant usability breakthroughs.

Institutional custody solutions emerge as a critical factor for widespread acceptance. HighVibeAssets of Algopear echoes this sentiment, predicting a future where private keys become irrelevant to end-users. Ripple has strategically expanded its custody infrastructure through acquisitions to serve financial institutions.

The focus remains on abstracting technical complexities. "99% of users shouldn't need to understand private keys," emphasizes Mike Gehosky, underscoring the industry's shift toward seamless user experiences. Ripple's advancements aim to bridge the gap between institutional adoption and retail accessibility.

XRP Poised for Major Institutional Boost as 401(k) Policy Shift Opens Door to Trillions in Potential ETF Inflows

Market analysts are predicting a seismic shift for XRP as recent changes to U.S. retirement account regulations could funnel trillions into cryptocurrency ETFs. The executive order signed by former President Trump paves the way for alternative assets like XRP to enter 401(k) portfolios—a move that could dramatically alter the digital asset landscape.

Paul Barron, a prominent market commentator, emphasizes the timing couldn't be better for XRP. With ETF approvals potentially coming as soon as October, the cryptocurrency stands at the confluence of regulatory progress and institutional adoption. "This represents a watershed moment," Barron notes, "where everyday investors gain exposure to high-growth assets through traditional retirement vehicles."

The numbers speak volumes. U.S. 401(k) plans currently hold between $7-9 trillion in assets. Rupert from AllinCrypto confirms that even a fractional allocation to XRP ETFs could reshape market dynamics: "When retirement funds meet crypto ETFs, we're looking at an entirely new liquidity paradigm." This institutional endorsement could propel Ripple into the ranks of next-generation financial giants while rewarding long-term XRP holders.

Ripple's Strategic Credit Line to Gemini Sparks Institutional Stablecoin Adoption Speculation

Ripple's $75 million credit facility to Gemini—expandable to $150 million—has drawn attention beyond its role as a liquidity lifeline for the exchange. The deal, disclosed in Gemini's IPO filing, comes as the platform reported $282 million in losses and over $2 billion in liabilities for H1 2025. Analysts suggest Ripple may use the arrangement to promote RLUSD, its dollar-backed stablecoin, by denominating additional draws in the token.

The move mirrors Ripple's earlier settlement strategy with Bullish, where RLUSD and USDC facilitated $1.15 billion in IPO flows. Institutional adoption of RLUSD could accelerate if Gemini settles its public listing proceeds through the XRP Ledger, reinforcing Ripple's infrastructure as a settlement layer.

Concurrently, Ripple's July application for a U.S. national trust bank charter signals broader ambitions. Approval would grant access to Fed reserves and FDIC-insured crypto products—potentially positioning the company as a bridge between traditional and digital finance.

XRP Rally to $3,000 Would Benefit Only a Select Few, Analyst Argues

A crypto analyst known as 24hrsCrypto has challenged the popular narrative that an XRP price surge to $3,000 would create widespread wealth. The argument centers on the uneven distribution of XRP holdings, with data showing most wallets contain negligible amounts.

Over 3 million wallets hold between 0-20 XRP—worth less than $25 at current prices. These are likely exchange dust or test wallets. Another 2.5 million wallets fall into slightly higher tiers, but still represent modest holdings. The concentration of wealth becomes apparent in the upper echelons of the rich list.

Skeptics maintain that even a $100 XRP price would require an unrealistic market capitalization. The debate highlights the tension between retail investor optimism and the mathematical realities of token distribution.

How Ripple's XRP Indirectly Integrates with SWIFT Through Third-Party APIs

Ripple Payments and XRP can interact with SWIFT without a formal partnership, according to XRP community researcher SMQKE. The connection is facilitated by third-party vendors like SAP, Temenos, and CGI, which provide API bridges enabling RippleNet to receive SWIFT's MT103 payment messages via HTTPS.

When a payment is initiated on SWIFT GPI, the message travels through traditional banking channels before reaching RippleNet via these APIs. RippleNet then routes the transaction through exchanges, using XRP as a liquidity tool within its settlement layer. This indirect pathway allows banks on RippleNet to settle transactions originating from SWIFT.

The revelation has sparked debate within the crypto community, with figures like Crypto Eri questioning the legitimacy of SMQKE's claims. Ripple engineer Neil Hartner has yet to publicly address the speculation.

Will XRP Price Hit 3?

Based on current technical indicators and fundamental developments, XRP shows strong potential to reach and exceed the $3 level. The asset is currently trading at $3.0266, essentially at the target threshold. Technical analysis reveals bullish MACD momentum and positioning within Bollinger Bands that suggest upward movement capacity. Fundamentally, the resolution of the SEC lawsuit and multiple institutional adoption catalysts provide strong support.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $3.0266 | At target level |

| 20-day MA | $3.0946 | Slight resistance |

| MACD | 0.0776 | Bullish |

| Bollinger Upper | $3.3577 | Potential upside |

BTCC financial analyst Robert states, 'The convergence of technical momentum and fundamental catalysts creates a favorable environment for XRP to not only hit $3 but potentially establish new support levels above this psychological barrier.'